How Freelancers Can Max Out 2026 Contribution Limits - Solo 401(k), Roth IRA, HSA

The 'don't blame me' blurb: I am not a financial advisor, portfolio manager, or accountant. This is not tax or investment advice; it's information to get you going. Please consult your trusty professional and do your due diligence. Carry-on!

TL;DR

The contribution limits change some years to account for inflation; Uncle Sam isn’t raising them to be nice.

New rules exist for Solo 401(k) catch-up contributions for those age 50+.

These three accounts can save you a fortune in taxes and create real wealth down the track.

Here we go, 2026! What could possibly go wrong, right?

Bookmark this page so you can come back and check in from time to time. Send it to your freelance/self-employed friends and colleagues. Let’s all help each other plan and invest for the future.

Solo 401(k) — also know as an Indvidual 401(k), One-Participant 401(k).

| Age Group |

Employee Contribution |

Catch-up Contribution |

Super Catch-up |

Max Combined Employee+Employer |

|---|---|---|---|---|

| Under 50 | $24,500 | $0 | N/A | $72,000 |

| 50 - 59 | $24,500 | $8,000 | N/A | $80,000 |

| 60 -63 | $24,500 | N/A | $11,250 | $83,250 |

| 64+ | $24,500 | $8,000 | N/A | $80,000 |

Remember, with a Solo 401(k) you are the employer and the employee.

Employer contributions remain at an additional 20% of net self-employment income for sole traders. For S-Corps, an additional 25% of the W-2 amount you paid yourself, plus your spouse if they also have a Solo 401(k).

NEW RULE for 2026 — Roth Requirement for High Earners: Starting in 2026, for age 50+. If your prior-year wages (specifically Box 3 of your W-2) exceeded $150,000, the IRS requires that your catch-up contributions be made on a Roth (after-tax) basis. It applies to:

Only to the employee catch-up contribution (not the employer contribution).

Only if you had prior-year FICA wages over the threshold.

The income test is based on prior-year FICA wages

→ W-2 Box 3 (Social Security wages) or Box 5 (Medicare wages)Sole Traders are exempt. If you’re self-employed with no W-2 wages, you’re exempt from the mandatory Roth catch-up rule. (Note: S-Corps, you MUST pay yourself a ‘reasonable salary’ under IRS rules.)

Read about the Solo 401(k) here if you haven’t read about it yet.

Roth IRA and Backdoor Roth IRA

There is some confusion out there about what a Backdoor Roth is. There is only one Roth IRA, but there is an IRS-accepted backdoor Roth IRA conversion to get around the income cutoff limit.

Read more about the Roth IRA and the backdoor method. Giggle about the backdoor all you want, but it will massively cut your tax bill later in life.

NOTE: Yes, you can have a Solo 401(k) and a Roth IRA! They have separate contribution limits. Your accountant didn’t tell you that, did they? You’re welcome. Name your first child after me.

The IRS has raised the 2026 contribution limits.

| Age Group |

Annual Contribution Limit |

Notes |

|---|---|---|

| Under 50 | $7,500 | |

| 50+ | $8,600 | (Includes $1,100 catch-up |

Full contribution income limits (if you hit these, use the backdoor contribution method).

Income over these levels starts to reduce and then eliminate the contribution amount:

$153,000 for singles.

$242,000 for married filing jointly.

WARNING: Don’t forget, you cannot do a Backdoor Roth IRA conversion if you have an existing Traditional IRA with money in it. You run headfirst into the IRS's pro-rata rule.

HSA - Health Savings Account

The HSA is the most underrated retirement investment account. The IRS has raised the contribution limits for 2026. It’s a triple threat—contributions are tax-deductible, growth is tax-free, withdrawals are tax-free if used for qualified medical expenses, or withdrawals are treated like income after age 65, like an IRA (401(k). Note: The FSA is the crap one that's use-it-or-lose-it.

Read about the HSA here.

| Coverage Type |

Annual Contribution Limit |

Catch-up (Age 55+) |

Max Limit |

|---|---|---|---|

| Self-Only | $4,400 | $1,000 | $5,400 |

| Family | $8,750 | $1,000 | $9,750 |

To be HSA-eligible, your health plan must have:

An annual deductible of at least $1,700 for self-only coverage and $3,400 for family coverage

Out-of-pocket maximum, including annual deductible, does not exceed $8,500 for self-only coverage and $17,000 for family coverage.

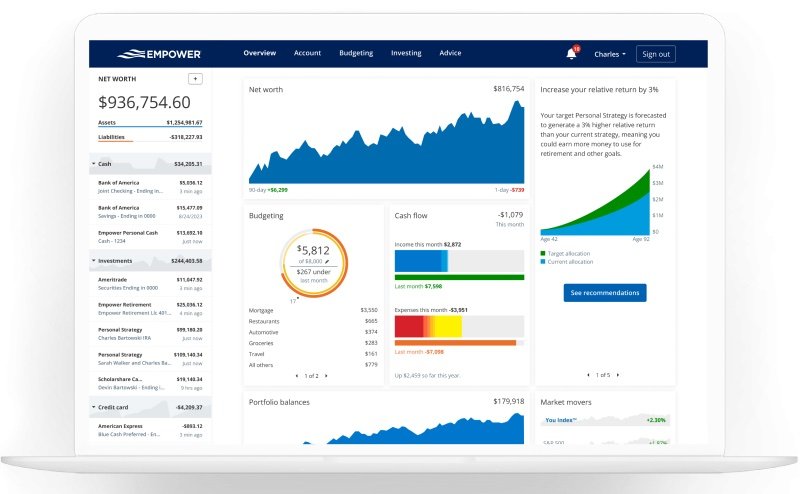

Schwab does not have a HSA, so my HSA is with Fidelity. The funds in it are invested in a Three-Fund Portfolio. I plan to use it as a long-term investment account and not to pay for medical expenses now.

That’s it, 2026 here we come. As always, money is a tool, not the goal. Investing now means more choice and freedom for you and your family in the future.