Your freelance/self-employed emergency fund money and where to put it.

The banged-up solopreneur/freelancer—time to access the emergency fund.

The ‘don’t blame me’ blurb: I am not a financial advisor, portfolio manager, or accountant. This is not tax or investment advice; it’s information to get you going. Please consult your trusty professional and do your due diligence. Carry-on!

Updated: April 2025 to include using a U.S. Treasury ETF/fund as an option.

As a freelancer or single-person business, your emergency fund is the first thing you should establish.

You know that the shit can hit the fan fast (a recession, an injury, or the loss of your main client). If it does, you need to be able to pay your living expenses until you get back on your feet. That means having a dedicated emergency fund account.

TL;DR

Have at least 3-6 months of living costs saved, perhaps more if you’re in a volatile industry.

Having an emergency fund will reduce stress on you, your business, and your relationships.

Keep the money in a High-Yield Savings Account (HYSA), or

Use a U.S. Treasuries ETF like Vanguard’s VBIL to avoid state tax on the interest.

If you are more unlikely to need to draw on the fund, consider using a Three-Fund Portfolio. It’s a higher risk but a higher return on the emergency fund money. This is unsuitable for most people.

How much cash should you have stashed away?

A common figure is to have 3-6 months of expenses as your emergency fund.

It comes down to a personal choice of how risk-averse you are and whether you have other assets that can be liquidated (sold) quickly in an emergency, like shares in a taxable brokerage account.

As your responsibilities grow—starting a family, buying a house—so should your emergency fund to cover your expanding expenses.

Hopefully, you also have a growing Solo 401(k); if not, get that going ASAP. Click here for the guide, or open a Roth IRA if your income is mostly W-2. Investing will make you rich, slowly.

Side note:

You should avoid withdrawing money from retirement accounts like the plague in an emergency. There could be a penalty, and you are taking money away from future you.

Your emergency fund comes down to this:

Here's the lowdown on the essential costs you may want to cover:

Housing Costs: Your rent or mortgage, it’s a no-brainer.

Utilities: You have to keep the lights on and the water running.

Food: Think basic groceries that can stretch for meals. Ramen can be your best friend.

Healthcare: If you've got meds or ongoing medical needs, they can't be ignored. Health insurance is super important, especially if you've got a family. Don’t stop exercising either, long-term this is so important.

Car Expenses: If you have a car and need it for job interviews or essential travel.

Minimum Debt Payments: Make at least the minimum payments to avoid penalties and to improve your credit score.

Basic Personal Expenses: We're talking toiletries, household items, and maybe a small budget for clothing if necessary.

Here’s what you can probably cut back on or drop:

Cable TV subscriptions, expensive gym memberships (workout other ways for a while), streaming services.

Eating out, takeaways, and expensive snacks.

Luxury items, like high-end clothes and gadgets.

Non-essential travel or entertainment

Where to stash the cash?

Eh, no.

Here are the three main options:

High-Yield Savings Accounts (HYSA).

U.S. Treasuries-based ETF or mutual fund to avoid state and local tax.

Stock market Three-Fund Portfolio (60% stocks, 40% bonds).

1 - The High-Yield Savings Account (HYSA) Option

Chances are your bank’s savings account offers a lame interest rate (we’re talking 0.1 - 0.5%), so we need to use a specialty HYSA bank. Honestly, the term ‘savings account’ is a joke at most main street banks.

Is a HYSA at a bank safe?

Banks are insured by the FDIC. If your account balance is below $250,000, Uncle Sam will guarantee your money if the bank goes bust.

Look for specialty banks offering a High Yields Savings account like:

I put part of my emergency fund in Maxmyinterst.com.

Max, or Maxmyinterest.com, is a company I first read about in Jason Zweig’s investment column in the Wall Street Journal, so thank you, Jason!

Max is an online platform that allows users to instantly open bank accounts with banks around the country, offering the highest savings rates. There are no forms or bank websites to log in to; Max handles it all.

There is an $80/year fee, so if your emergency account is small, it may not be worth using Max.

Points to consider:

If the Federal Reserve base rate is low, the interest rate on the HYSA may pay a very low interest rate.

The interest payments generated by the account is taxable at your personal interest rate and must be declared on your tax-return yearly.

Keep each account under $250,000 to be covered by the FDIC insurance.

2. A U.S. Treasuries ETF or Mutual Fund

Here's a tax hack many people don't know about: A U.S. Treasuries-based ETF or mutual fund offers dividends that are exempt from state and local income taxes. You hold the ETF or fund in a taxable brokerage account with a provider like Schwab or Vanguard.

I live in D.C., which results in an 9.25% tax saving for me. However, this account offers no advantage if you reside in a state without state income tax, such as Florida or Texas.

Example:

$50,000 at 4% will earn $2,307

A 9.25% tax saving on $2,307 = $213

No big deal? Over 30 years, that’s $6,300

How does it work?

The ETF or mutual fund buys Treasuries from the U.S. government, which are held in the ETF/fund. The interest earned from the Treasuries is paid into your brokerage account monthly as a dividend. I set my account to ‘re-invest dividends’ so the money paid out automatically buys more of the ETF or fund’s shares. This starts the compound interest snowball effect.

The dividend rate is usually the same as, or higher than, a HYSA interest rate.

Whoa! I need the cash now!

Need cash? Sell part of the ETF/fund, wait three days for the money to clear, and then transfer the money to your checking account.

Use one of these Vanguard products. They have the lowest fees at 0.07%

If you have an account with Vanguard, you can invest in the mutual fund VUSXX.

Or, buy the ETF VBIL in a taxable brokerage account like a Schwab or Fidelity account.

I suggest opening a separate account with whoever you use (it takes a few minutes) to hold the Treasuries ETF/fund. Brokerages are not required to report state tax-exempt dividends separately, so you need to tell TurboTax or your accountant that the dividend income is from a Treasury-based account. Having a separate brokerage account for VBIL means the dividends don’t get mixed in with non-exempt payments.

Points to consider:

Treasuries are not FDIC-covered investments but are issued and backed by the U.S. government.

The brokerage account you hold them in is protected by the SIPC (Securities Investor Protection Corporation). It covers cash and securities in a brokerage account up to a limit of $500,000, including a maximum of $250,000 in cash.

I only recently discovered the treasury-based account hack myself. Why my accountant never suggested it, I do not know!

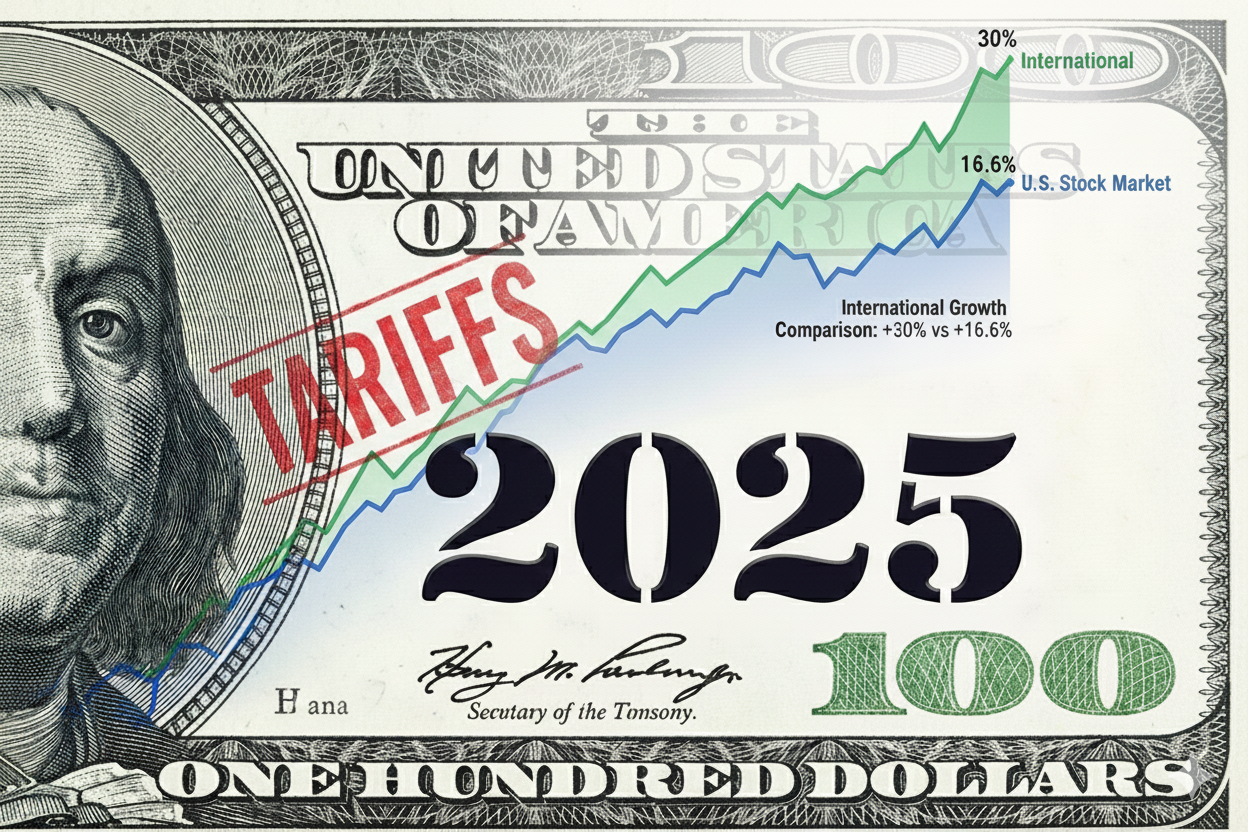

3. Using a 60/40 Three-Fund Portfolio for part of an emergency account?

This higher-risk option is not suitable for most people — You could keep some of your emergency funds in a Three-Fund Portfolio (TFP), or all of the funds if you think you are unlikely to ever dip into them.

What’s the risk here?

If the market crashes and you need to sell the ETFs to use the emergency funds, you may lose money. The three-fund option is unsuitable for most people, but it is worth discussing.

Read about the Three-Fund Portfolio here. It’s a portfolio used by millions of investors and the backbone of the Freelancer Finance Solo 401(k) and Roth IRA.

Why are we talking about it?

The money in your emergency account will sit there for much of your lifetime, and hopefully, you’ll never use it.

$50,000 emergency fund for 30 years if you never touch it:

HYSA: at an average of 3%, it will grow to $121,000

Three-Fund 60/40 portfolio: earning 7% will grow to $380,000

If the current interest rate or Treasuries rate is high, stashing a lot of cash in a HYSA isn’t too bad. As I write this, at the start of 2025, the rates of HYSA accounts and U.S. Treasuries are around 4%. The return on Three-Fund Portfolio (60% stocks, 40% bonds) long-term is around 7%.

But if the HYSA rate was 1%, that’s not so great.

Points to consider:

There will be a lot more volatility and risk in a Three-Fund portfolio.

If the market is crashing and you need to sell the ETFs to use the emergency funds, you may make a loss. However, that loss is a tax deduction of up to $3,000 that year, with the rest deferred and claimable in subsequent years.

The portfolio's 40% bonds portion is safer and usually not very volatile.

Selling part of the portfolio to use the funds for most will result in a 15% capital gains tax on any profits, not your effective tax rate, which is likely to be in the 25-30% range.

Again, the TFP as an emergency account is not for most people, but now you know it’s an option!

Me: where is my emergency fund?

Me: 80% of my emergency fund is in VBIL to avoid D.C. state tax. It’s in a separate account inside my Schwab account (I have a Traditional Solo 401(k), a Roth Solo 401(k), a Roth IRA, and a taxable brokerage account, all under the same login.)

The remaining 20% is in Maxmyinterest.com. I already have a decent taxable brokerage account with a TFP that I can sell and get access to the cash, so I don’t need to add any more into that for an emergency fund.

Wrapping this up.

As a freelancer, your emergency account is the first thing you should establish. Next, start banging money into your Solo 401(k), or Roth IRA if you are primarily W-2. This is how we get rich, not only by working our asses off, but by investing.

Increase the size of your fund as your cost of living increases due to a bigger house and mortgage, having kids, and all of that. Otherwise known as life.

Financial stress is the worst. It affects your relationships and your health. Be prepared so you are chill if it all goes a little wrong.

Comment below if you have other options to suggest or if you have questions!

If you open an account with Maxmyinterest.com or an Individual Schwab account, they pay me a small affiliate fee. I put it in my Solo 401(k)!