The Knowledge Blog

Posts on finance, investing, business practices, and other oddball topics for freelancers. Grab your favorite beverage and get stuck in.

Latest Posts

Your freelance/self-employed emergency fund money and where to put it.

You’re self-employed, and if it all goes horribly wrong, you can’t make any income for a few months. Have a plan and stash some cash.

2025 and Your Tax Rate — it’s not one rate

It’s often misunderstood how the states and feds tax us. A misconception is that once someone hits a certain income, all of their hard-earned money gets taxed at a higher rate. This is not the case.

The Stock Market. Big and Scary? Nope - It Creates Wealth In The Background.

The stock market is often widely misunderstood due to the hype in the media reporting on short-term market moves. That and the jibba-jabba of your next door neighbor or some guy in a bar. It’s the long term that matters. We need to ignore the noise.

The HSA - Health Savings Account. Another sweet tax deduction

The HSA (Health Savings Account. Make your out-of-pocket medical expenses a sweet tax deduction. The money is always yours; it’s not ‘use it or lose it.’

The $93,550* Triple Stack: Deduct + Tax-Free Growth

These are the primary retirement options for freelancers and single-person businesses. Combined, you can get a huge tax deduction and protect up to $89,800 per year from the taxman.

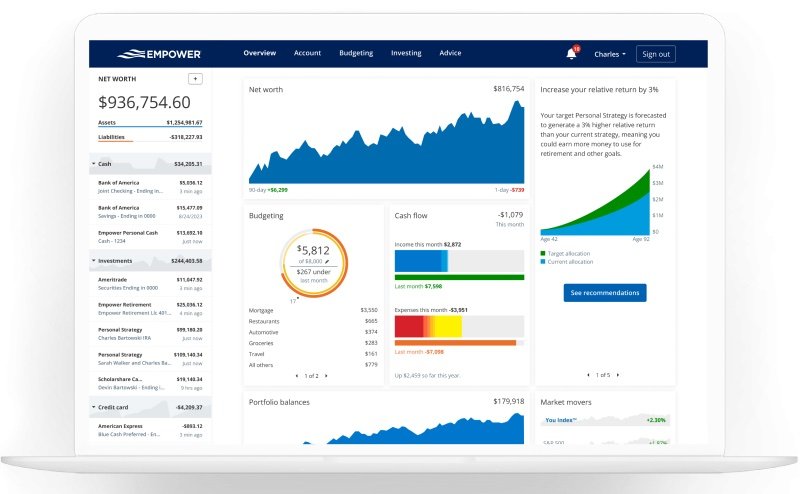

Empower Financial Dashboard — one to rule them all

The Empower Financial Dashboard: the magic crystal ball for freelancers that shows you your whole financial and investment life. And, it's free.

Why can’t I just pick my own stocks and make the big bucks?

This is called stock picking. Investors try to pick winning companies like Apple and Telsa or some unknown startup. Here is the problem, no one who stock picks will ever beat a three-fund portfolio long term!

My name is Chris Albert. I’m a 52-year-old freelance Director of Photography and studio owner who built a seven-figure portfolio from zero—no inheritance, no financial background, just consistent saving and sensible investing over 30 years.

Financial institutions consider me a ‘high net-worth individual’. At Schwab, as a $1 million+ account holder, I qualify as a Schwab Private Client Services customer, and, under SEC rules, I am considered an Accredited Investor.

Why the website? I built this site because I couldn't find one place that explained what and how freelancers like us should set up retirement accounts (the Solo 401(k), Backdoor Roth IRA, and HSA) and what investments to put in them—without the sales pitch, fees, or the overly-complicated Wall Street products.

We are going to get rich slow. In later years, live more, work less.