The $93,550* Triple Stack: Deduct + Tax-Free Growth

The Solo 401(k), Backdoor Roth IRA, and HSA.

Freelancers pondering tax-protected retirement vehicles. It's boring, but it will make you rich.

The ‘don’t blame me’ blurb: I am not a financial advisor, portfolio manager, or accountant. This is not tax or investment advice; it’s information to get you going. Please consult your trusty professional and do your due diligence. Carry-on!

Updated Jul 16, 2025

The Solo 401(k), Backdoor Roth IRA, and HSA combined give freelancers and single-person businesses the ability to deduct and protect a massive amount of money from the taxman every year.

*The yearly maximum contributions of the three accounts combined are affected by your age:

Up to Age 49 = $81,300

Aged 50 = $89,800

Age 60-63 = $93,550

Plus, a spouse who works as a part-owner or employee of the business may also have a similar limit.

If you have a SEP-IRA, it was once the go-to option for solo entrepreneurs, but there are now better alternatives available. Even some accountants haven't caught up with what works best for single-person businesses.

What Investments Go Inside These Accounts?

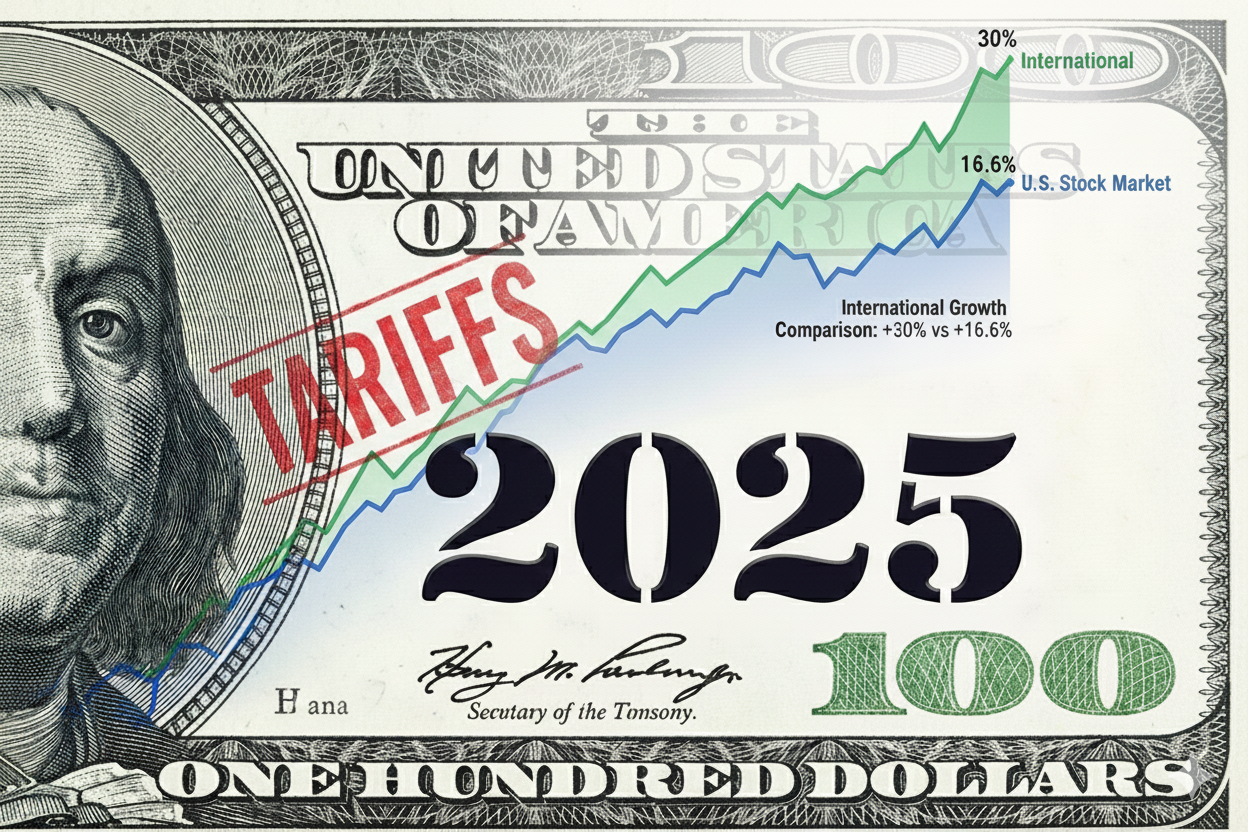

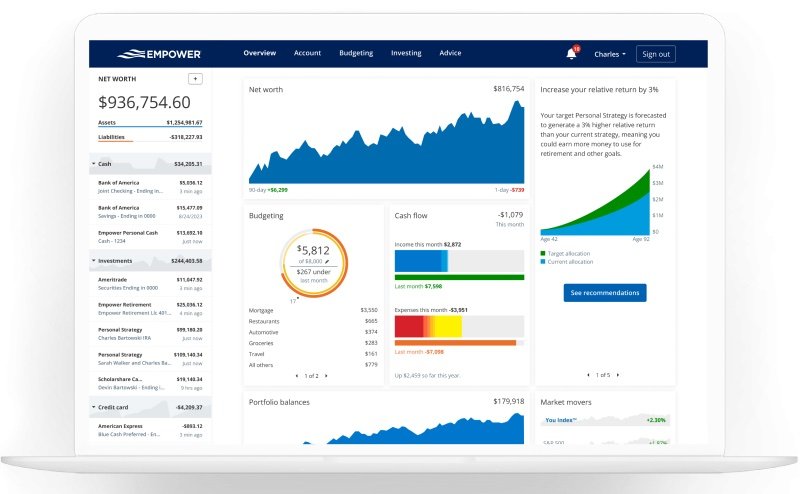

Think of the accounts as the wrapper protecting the candy from the taxman. They all can hold stocks, Mutual Funds, ETFs (use our favourite Three-Fund Portfolio), as well as Target Date Funds. Schwab, E*Trade, and Fidelity are all good companies to use.

Let’s break down the actual options:

The Solo 401(k) — aka Solo 401(k)

This is for single-person businesses, freelancers, contractors, and your spouse. You cannot have any employees (except your spouse).

Income earned must be 1099, not W-2 income.

You can combine the Solo 401(k), Roth IRA and a HSA.

It has the maximum Solo 401(k) contribution in 2025:

Age 49 and under $70,000

Age 50+ $77,500

Age 60-63 $81,250

The breakdown:

Employee contribution of $23,500 — $31,000 if age 50+ — $34,750 if age 60-63 in 2025.

Plus an additional Employer contribution (that is, your company). Up to 20-25% of your income/profit, depending on whether you’re a sole proprietor or an S-Corp. Read the Solo 401(k) guide here.

Example: You are an S-Corp and paid yourself $100,000 in W-2 salary. Your company can now contribute up to an additional $25,000 to your 401 (k). For those who are not an S-Corp using payroll, there is a formula that comes out to about 20%; read about it here.

Traditional (pre-tax): The money is not taxed as it goes in, so it’s a huge tax deduction. You are taxed on it when you start withdrawing it in retirement, but most likely at a much lower rate than in your prime earning years.

A Roth Solo 401(k) is also allowable — you pay tax before the money goes in, but no tax when you use it in retirement.

You can open a deferred and a Roth Solo 401(k), but the limits below stay the same. You don’t get double. If you do have both, they must be with the same provider. You are not allowed to have multiple Solo 401(k)s with different providers.

SEP IRA - Simplified Employee Pension

Income earned must be 1099, not W-2 income.

You must use this one if you have even one W-2 employee who is not your spouse.

Contribution limits are potentially lower; your company can put in 25% of your income, but you don’t get the $23,500/$31,000 personal contribution, which you also get in a Solo 401(k) above. Example: if you pay yourself $150,000/year, with a SEP, you can only contribute $37,500. The maximum in 2025 is $70,000

You can’t do a Roth version of a SEP.

With a SEP, you must give your employee(s) the same percentage of your contribution.

You can open a SEP and contribute to the tax year before, but you can’t do so with the Solo 401(k). Example: In February 2024, you can open a SEP and contribute to tax year 2023 if you do not have a retirement account setup. You can do this up until March 15 for S-Corps and April 15th, 2024 for self-employed. For those of you just finding out about investing for retirement, this can be a great move. In the year 2024, you could then establish and utilize an Solo 401(k) retirement savings account.

Backdoor Roth IRA - Individual Retirement Account

The Backdoor Roth IRA is a nickname. It’s a regular Roth IRA, but we've used the backdoor funding method to legally avoid the income cutoff limit. Read the detailed post on the Roth IRA here.

The Roth IRA has a limit of $7,000 in 2025 and $8,000 if age 50+.

It is not a tax deduction, but you do not pay tax upon withdrawal.

If the majority of your income is W-2, then this may be the best option for you.

You can have an Solo 401(k), a Roth IRA and a HSA. Boo-Yah!

The backdoor method: Deposit money into an after-tax IRA. Wait a few days for the funds to settle. Contact your provider or complete an online form to roll it into your Roth IRA. They will issue the appropriate tax forms.

Some SEP plans will also allow an IRA through a loophole, but it depends on the plan.

If you already have money in another IRA, please check with your accountant or advisor. Having money in an IRA can affect the above Back Door Roth strategy, a gotcha called the ‘Pro-Rata Rule.’

The HSA - Health Savings Account

Technically, it’s an account designed to provide a tax deduction for medical costs, but it can be used as a very powerful retirement account.

You must have a High Deductible Health Plan. In 2025, your deductible must be at a minimum of $1,600 for singles, $3,200 for families.

Contribution limit of $4,300 limit for singles $8,550 for families

Funded by you from your personal checking account, not from your business account. (Make sure you have separate accounts for your biz and you as an individual; mixing them gets very confusing for your accountant or the IRS in an audit.)

You can use the funds to pay for qualified medical expenses, or invest the money and use the account like you would use an Solo 401(k) or Roth IRA

Read the detailed post on the HSA here.

The Exciting Conclusion?

For those with mostly 1099 income, go with the Solo 401(k) if you don’t have employees besides your spouse. Contribute to a Backdoor Roth IRA and HSA if you have excess cash. Chat with your accountant or financial advisor about it.

Just to let you know, some accountants are not up to date on what an Solo 401(k) is, according to what visitors of this website have told me.

Some accountants are still advising clients to use a SEP-IRA. If that happens, have them look under the hood of the Solo 401(k), and they’ll understand.

What are your tax savings hacks? Comment below!