A Freelancer's Guide to Not Dying Broke — Why we suck at saving for retirement.

The ‘don’t blame me’ blurb: I am not a financial advisor, portfolio manager, or accountant. This is not tax or investment advice; it’s educational information to get you going. Please consult your trusty professional and do your due diligence. Carry-on!

Freelancers: Spread the word, talk about money with your crowd.

The ‘Retirement in the USA: The Outlook of the Workforce - 2025’, survey from the Transamerica Center for Retirement Studies is out, and it’s an eye-opener.

Let's talk about the elephant in your home office: retirement savings. Retirement does not mean hobbling off into the sunset. It means Stage Two. At age 55-60, starting to chill, working less or not at all.

While your traditionally employed friends have HR departments force-feeding them 401(k) plans, you're busy trying to figure out if you can expense that second monitor as a business expense. (Spoiler: you probably can.)

The stats from the study are about as pretty as a stack of bills sitting on your desk.

79% of self-employed workers are saving for retirement, but only 44% say they are consistently saving.

A whopping 21% of people say they do not save at all.

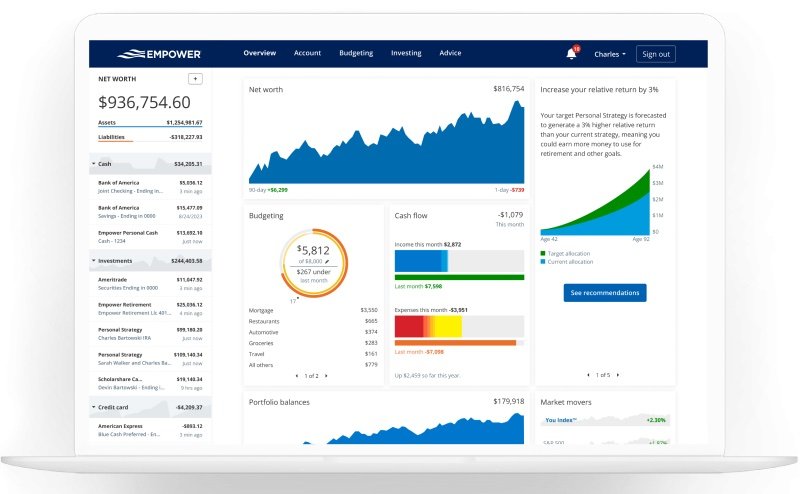

Only 22 percent of self-employed workers have a financial strategy for retirement in the form of a written plan. (Want some help? I use Boldin, a web-based platform, with humans if you need them.)

The median retirement savings for self-employed workers is $87,000. Retirement won’t be fun at this savings level.

13% of self-employed workers have no retirement savings at all.

Why We're Terrible at This

Before you beat yourself up too much (save that energy for when you underquote a project), know that the deck is stacked against us freelancers:

Income Rollercoaster: One month, you're contemplating which fancy cheese to buy, the next, you're calculating if ramen qualifies as both breakfast and dinner. Traditional retirement plans weren't designed for people whose income graph looks like an EKG reading during a horror movie.

No Corporate Nudging: Nobody's automatically enrolling you in anything except spam email lists. Without that corporate infrastructure forcing savings upon you, it's easy to put it off until that mythical "someday" when you'll "have extra money." (Narrator: That day never came.)

Lack of Education: We have been hung out to dry on this one. Do you remember anyone teaching you about investing in high school or university? Your union? Probably not. Freelancer Finance is here to change that!

DIY Exhaustion: After handling your own marketing, accounting, client management, professional development, and actual work, who has the mental bandwidth to research retirement options? You barely remember to drink water some days.

The "I'll Start Later" Trap

When you put off investing until "later," you're essentially telling compound interest: "No thanks, I don't want your free money." Compound interest is like a snowball rolling downhill—the earlier you give it a push, the more snow it collects on the way down.

Our investments (three ETFs or one Target Date Fund) make around 7%-8% annually over the long term. This doesn't just add up—it multiplies. Your money makes money, which then makes more money. Look at what happens between the ages of 50 and 55 in the example below. Yeah, it rockets from $650k to $ 1 mil in five years. Yes, you can do this.

7% average long-term growth rate from a Target Date Fund or Three-Fund Portfolio.

The median retirement savings for self-employed individuals is $87,000. That might sound decent until you realize it would generate about $3,480 per year in retirement using the 4% rule. Unless you plan to retire to a cave (with surprisingly good Wi-Fi), that won’t cut it. Read more about spending your investment moolah later in life here.

Retirement Plans That Don't Require an HR Department

Fortunately, Uncle Sam and the financial world has noticed our existence and created some options that don't require having employees or wearing pants to meetings:

The Solo 401(k) — aka the Individual 401(k): The overachiever of retirement accounts, it blows away any other type of account. You can contribute as both employer AND employee, with a 2025 limit of $77,500 if you're over 50. It's like being your own boss and your own favorite employee simultaneously.

Roth IRA: If your income is mostly W-2 this is for you. You can also have an Solo 401(k) AND a Roth IRA. It has lower contribution limits ($7,000 >age 49, $8,000 for 50+), but requires roughly the same effort as ordering takeout. If your freelance business is still in the "eating ramen while crying" phase, start here.

HSA (Health Savings Account): With a $4,300 limit for singles, $8,550 for families in 2025, your contributions are a tax deduction, gains grow tax-free, and if you use money for medical expenses, spending it is tax-free. Or, leave the money invested until after 65 and spend the moolah on anything and pay regular income tax on the withdrawals (the same as a traditional Solo 401(k)).

All of these accounts can contain ETFs, stocks, and mutual funds. They are a wrapper around a brokerage account.

Starting When You're Broke-ish

"But I can barely pay my bills!" you protest, while simultaneously upgrading your Adobe subscription and buying another online course you'll never complete.

Start with 5% of whatever you make. Had a $2,000 month? That's $100 toward future you. Had a $500 month? That's $25. Even small contributions add up thanks to the magic of compound interest, which Einstein allegedly called the eighth wonder of the world. (Though if Einstein were a freelancer today, he might have said the eighth wonder is clients who pay on time.). Start investing 10% of your gross income as soon as you can. 20% would be epic and lead to chilling out earlier, later.

The Power of "Future You" Thinking

Prioritize decisions that help future you. Current You and Future You are technically the same person, but Current You treats Future You like that distant relative you're kind of obligated to care about, but don't really want to help move apartments.

Our brains have not fully evolved from humanity’s early years, where we were routinely eaten by something toothy at the ripe age of 35. We have yet to develop the ability to think very far into the future. Seriously, it’s a thing.

Consider this: Future You will either thank Current You profusely, or curse your name because you are broke and your dog left you. And unlike those clients who ghost after you send the invoice, Future You will definitely be showing up to collect.

$20,000 invested today, growing at 7%, will be $152,000 in 30 years. Boom.

The Freelancer Advantage

Here's our secret superpower: flexibility. While traditional employees have to beg for raises to increase their retirement contributions, we can simply decide to take on an extra project specifically for retirement savings.

Had an unexpectedly good month? Boom—bonus contribution. That ability to scale our retirement savings with our income is something cubicle dwellers can only dream about while staring sadly at their SAD lamps.

Accounts like the i401k allow us to contribute more. A 50-year-old staffer can contribute $31,000 to a 401k, while a freelancer the same age can contribute $77,500. That means a much bigger tax deduction and a bigger retirement pot to have fun with later. Boo-ya, Future You!

Getting Started (Like, Actually Started)

Choose your weapon: Pick the retirement account that matches where you are right now. Making bank? The i401k. Just starting out? The Roth IRA (maybe using the Backdoor Roth IRA method), plus the HSA. At 52, I have all three accounts going. There are guides here at Freelancer Finance on all of them.

Automate what you can: Set up automatic transfers on the days clients typically pay. If that's too unpredictable, set a monthly calendar reminder to manually transfer a percentage of whatever you earned.

Treat it like a client invoice: We'll move heaven and earth to deliver to clients on deadline. Apply that same energy to your retirement contributions. It's just another deliverable, except the client is 55 or 60-year-old you, and they're extremely demanding about being able to afford fun things.

The Bottom Line - Get Going Today

The stats say we're falling behind, but they don't have to define your personal story. Even starting with embarrassingly small contributions is infinitely better than the zero that most of your freelance peers are saving.

Besides, what's the alternative? Working until you're 90, trying to keep up with whatever TikTok has evolved into while your carpal tunnel makes it impossible to type without voice recognition software?

Start today, with whatever you can. Future You is counting on it—and unlike your flakiest clients, they're definitely not going anywhere.

Head over to the:

i401k guide: to start the snowball rolling.

The Roth IRA: If you’re income is mostly W-2. You can also have Roth IRA and an i401k.

The HSA: More tax-deductible investing and/or paying for medical expenses for all.

An hour or two of learning and a little paperwork now will earn a $1 million+ for Future You. Send this to your fellow freelancers and colleagues.

What is your situation? Comment below, freelancers, let the chatting begin!

*Sources:

‘Retirement in the USA: The Outlook of the Workforce’ (2025). Transamerica Institute. Key highlights are on p.12. P.25 retirement saving stats for self-employed.

‘Freelancers, Sole Proprietors, and Other Nontraditional Workers Have Little Retirement Savings’ (2021). Pew Research.