Freelancers, it’s time to rebalance Your Three-Fund ETF Portfolio

The ‘don’t blame me’ blurb: I am not a financial advisor, portfolio manager, or accountant. This is not tax or investment advice; it’s information to get you going. Please consult your trusty professional and do your due diligence. Carry-on!

TL;DR

Rebalance once a year. Pick a date and stick to it.

Why? Diversification. We need to keep our eggs in their different baskets so our investment ass is covered.

If you chose a Target Date Fund, then you can skip this; the fund does the allocation and rebalancing for you.

Nifty calculator below.

You picked a Three-Fund Portfolio:

U.S. Stocks — SCHB or VTI

International Stocks — SCHF or VXUS

U.S. Bonds — SCHZ or BND

using either the Schwab or Vanguard ETFs. You’re investing every quarter like a champion. Now, one quick New Year task — and it takes less time than ordering a coffee.

You chose your allocation, say 70/20/10 in my case, it’s 55/25/20.

I’m 52 now, so I want more bonds, and I’m worried the U.S. is overvalued and a little nutty at the moment — whatever lets you sleep at night, depending on your age and tolerance for volatility. You’re buying every quarter like clockwork. Nice work. You’re ahead of most freelancers or self-employed who are still thinking about it.

Need a refresher? Read the article on the Three-Fund Portfolio.

Here’s the thing: the stock market doesn’t care about your carefully chosen percentages. It’s going to do its own thing — and over 12 months, your allocation is going to drift. That’s where rebalancing comes in.

What Is Rebalancing? (It’s Not Yoga)

Rebalancing is simply bringing your portfolio back to your target allocation. That’s it. No spreadsheet pain. No Wall Street jargon. It’s not thrilling, but if you skip it long enough, things start pulling to one side, and your portfolio can end up in a ditch.

Let’s say you started 2025 with a 65/25/10 split — 65% U.S. Stocks (VTI or SCHB), 25% International (VXUS or SCHF), and 10% Bonds (BND or SCHZ).

In 2025, International had a great year, gaining 30%, and the U.S. gained 16%. By December, your portfolio might look more like 63.7/27.5/8.8

That’s not catastrophic. But it’s not what you signed up for, either. Your eggs have quietly rearranged themselves in the baskets. We need to move them back.

As an aside, if you had a $200,000 portfolio in 2025, it’s now worth $236,600, an 18% gain. Not bad making $36,600 while doing nothing? A reminder, though, this was an above-average year, like 2023 and 2024. Don’t be surprised if, in a year or two, our portfolios end up in the red. Our long-term goal is 7-9% per year, otherwise known as the annualized gain.

Why Diversification Matters — A Quick Refresher

The whole point of the Three-Fund Portfolio is diversification. We spread our money across U.S. stocks, international stocks, and bonds because no one — and I mean no one — knows which sector will be the winner next year. Not the suits on CNBC. Especially not your brother-in-law who keeps texting you about crypto.

These guys don’t know either, but they get paid to yap.

Diversification means we’re not betting the farm on one outcome. If the U.S. market has a rough couple of years (hello, 2000 - 2009), our international holdings and bonds are there to soften the blow. If international stocks lag, the U.S. picks up the slack. It’s a team effort, and the team works best when everyone’s carrying their weight.

Getting greedy and staying with the ETF that’s outperforming can get you in trouble in the long term when the tide turns. Yes, it feels weird to sell some of the ETFs that are doing the best.

Ye Olde Wall Street saying:

“Bulls make money, Bears make money, Pigs get slaughtered.”

Think of it this way: You wouldn’t light your entire living room with one candle. You’d have a few lamps spread around. If one bulb blows, you’re not sitting in the dark. That’s diversification. It’s not about chasing the best return — it’s about delivering a consistently good outcome over decades.

We’re playing the long game here. We’re not day-trading; we’re building a retirement. A boring, beautiful, million-dollar retiremen

How to Rebalance (It’s Embarrassingly Simple)

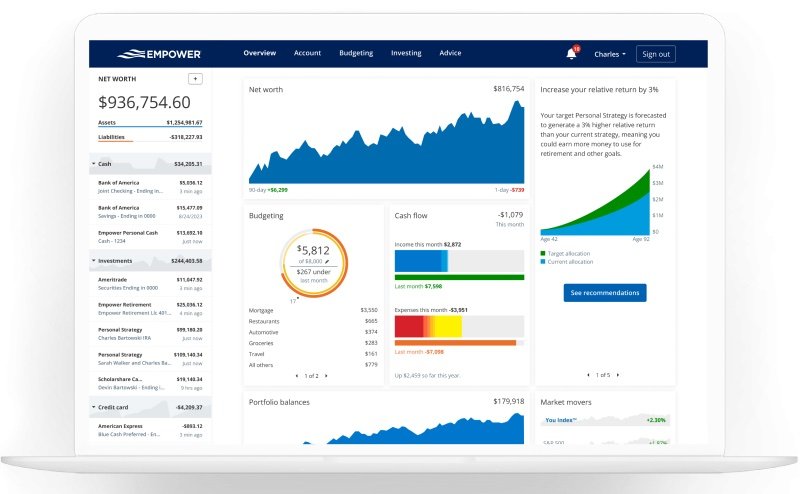

Step 1: Log into your brokerage account (Schwab, Vanguard, E*Trade — wherever your Solo 401(k), Roth IRA, HSA, or taxable account lives).

Use this calculator that I created (actually, Claude.ai made it while I made generally unhelpful suggestions). Rebalancing will only take a few minutes. That’s right, investing should be something that takes very little time or energy, just eep pounding in the cash.

Three-Fund Rebalancing Calculator

Enter your target allocation and current ETF balances. We'll tell you exactly what to buy or sell to get back on target. Twenty minutes, once a year.

What mix did you choose? Pick a preset or enter your own.

Log into your brokerage and enter the current dollar value of each ETF holding.

| Fund | Current Balance |

|---|---|

| U.S. Stocks VTI / SCHB |

$

|

| Int'l Stocks VXUS / SCHF |

$

|

| Bonds BND / SCHZ |

$

|

Your Rebalancing Results

| Fund | Current Balance | Target Balance | Difference |

|---|

Here's exactly what to buy or sell to get back to your target allocation.

💡 Inside a Solo 401(k) or Roth IRA, selling to rebalance has zero tax consequences — buy and sell away. In a taxable brokerage account, try directing new contributions toward the underweight fund to avoid triggering capital gains tax. Don't stress if you're off by a point or two — close enough is good enough.

Step 2: Buy/sell to get back to your allocation. Close the laptop. Come back next year and rebalance again.

Alternative Pro tip: If you’re still making contributions (and you should be), you can sometimes rebalance just by directing your new money toward the underweight fund. No selling required. This is especially nice in a taxable brokerage account where selling can trigger capital gains taxes. Inside a Solo 401(k) or Roth IRA, buy and sell away — there are no tax consequences for trades inside these accounts.

There’s also a nifty free rebalancing calculator at walletburst.com that does the math for you. Because, like me, maybe math isn’t your strongest suit.

Vanguard founder Jack Bogle:

“Don’t look for the needle in the haystack. Just buy the haystack.”

Changing your allocation

As you get older and get closer to using your accounts for income instead of working and adding to them, you may want to move more into bonds, as they have less volatility. A common retirement portfolio is about 40/20/40. Chatting to a CFP five years before retirement is a great idea. I plan on doing so.

At the start of 2025, I moved more into international stocks and bonds. I went from 75/15/10 to 55/25/20. Why? I’m now 52 and want to start chilling in the next 5-6 years, so I moved more into bonds. I moved from the U.S. to International because I think the U.S. is overvalued and too tech-heavy. There is a good chance I'll make less in the next few years, but I’m spreading my eggs for more diversification.

The Target Date Fund Shortcut

If all of this still sounds like one more thing on your already overloaded freelancer to-do list, I get it. The simple answer? A Target Date Fund automatically rebalances for you in the background. You just buy it and keep contributing money. Done.

If you want to switch from the three ETFs, simply pick the target date year you want to retire and buy that fund. Age 30 now and want to retire at age 60? Buy Target Date 2055.

Schwab target date index funds

Vanguard target date funds. (If you choose the awesome Vanguard funds, then you’ll need your brokerage account to be with E*Trade or Vanguard as the others charge fees each time you buy the Vanguard funds. However, Vanguard no longer has a Solo 401(k), only Roth IRA and brokerage accounts.

Wrapping It Up

Diversification is why the Three-Fund Portfolio works. Rebalancing is how you keep it working. The market is going to push your allocation around — that’s just what markets do. Your job is to nudge it back once a year.

• Rebalance once a year. Pick a date and stick to it.

• Don’t stress if you’re off by a couple of percent — just don’t let it drift 10% or more.

• Inside a Solo 401(k) or Roth IRA, selling to rebalance has zero tax consequences.

• In a taxable account, try to rebalance with new contributions instead of selling so you don’t get hit with capital gains tax.

• Or just buy a Target Date Fund and let it handle everything. No shame in that.

Keep buying, keep rebalancing, keep living your life. The portfolio works in the background. You go work on your craft, hang with your people, and let compound interest do the heavy lifting.

We are going to get rich, slow.

Spread the word about the Solo 401(k) with your freelance/biz friends and colleagues. Talk about money and investing. We need to help each other. Send them here to Freelancer Finance.