Three-Fund Portfolio Rebalancing Calculator

Rebalancing is simply bringing your portfolio back to your target allocation. That’s it. No spreadsheet pain. No Wall Street jargon. It’s not thrilling, but if you skip it long enough, things start pulling to one side, and your portfolio can end up in a ditch.

Read the article on rebalancing your portfolio here.

Read about the Three-Fund Portfolio here. It’s a simple, proven investment system used by millions of investors, with out the Wall Street fees.

Three-Fund Rebalancing Calculator

Enter your target allocation and current ETF balances. We'll tell you exactly what to buy or sell to get back on target. Twenty minutes, once a year.

What mix did you choose? Pick a preset or enter your own.

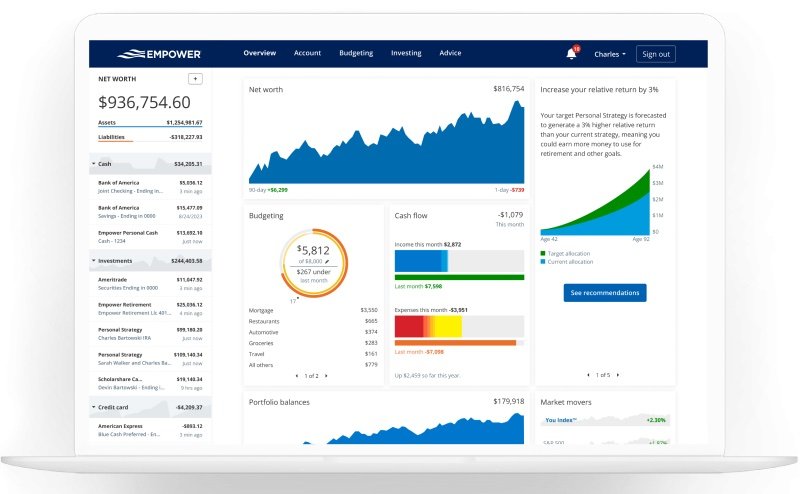

Log into your brokerage and enter the current dollar value of each ETF holding.

| Fund | Current Balance |

|---|---|

| U.S. Stocks VTI / SCHB |

$

|

| Int'l Stocks VXUS / SCHF |

$

|

| Bonds BND / SCHZ |

$

|

Your Rebalancing Results

| Fund | Current Balance | Target Balance | Difference |

|---|

Here's exactly what to buy or sell to get back to your target allocation.

💡 Inside a Solo 401(k) or Roth IRA, selling to rebalance has zero tax consequences — buy and sell away. In a taxable brokerage account, try directing new contributions toward the underweight fund to avoid triggering capital gains tax. Don't stress if you're off by a point or two — close enough is good enough.

Vanguard founder Jack Bogle:

“Don’t look for the needle in the haystack. Just buy the haystack.”