Freelance or Self-Employed in your 40s or 50s? Start Investing for Later, Now.

This is it. The day you started pounding away money for Future You.

The ‘don’t blame me’ blurb: I am not a financial advisor, portfolio manager, or accountant. This is not tax or investment advice; it’s information to get you going. Please consult your trusty professional and do your due diligence. Carry-on!

**I do not receive any compensation if you open an investment account below. I write to help educate freelancers who are not investment geeks like me.

TL;DR

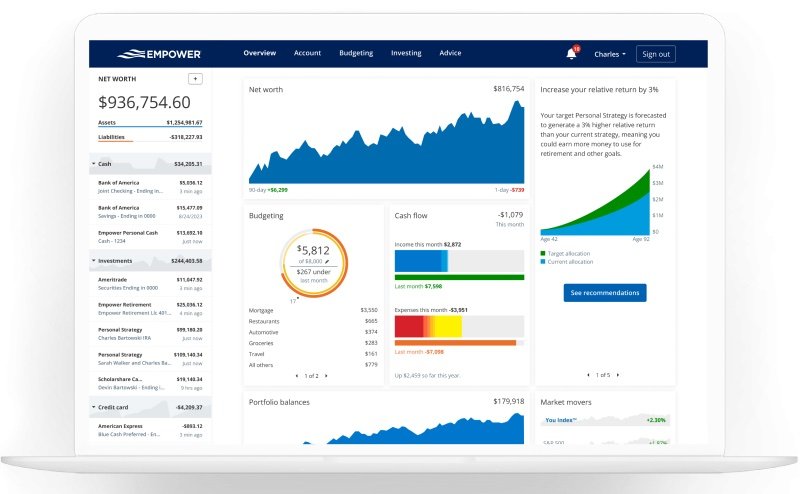

Setting up the account(s) takes an hour of setup time, then 20 minutes of your time every three months.

You don’t need to follow the stock market; ignore the noise and carry on.

Your contributions and compound interest will make you rich in the background.

Age 50 and haven’t invested for later? You could hit $600,000+ by 65.

Start investing with whatever amounts you can; it all matters. 5-10% your income is a great start.

It can be a massive tax deduction.

It’s not too late.

As a freelancer or self-employed professional, you've mastered the art of independence. You've built your business, found your clients, and created a life on your own terms.

However, if you're like many independent professionals, planning for the chill-out, slow-down phase (retirement sounds so final) might be the task that keeps sliding to the bottom of your perpetual to-do list. As Pink Floyd sang, “No one told you when to run, you missed the starting gun.” Yes, I just dated myself, big time.

If you're approaching 50 (or even beyond) and haven't started investing yet, you might feel like you've missed your chance. But here's the truth: you haven't. Fired up? Let’s go.

What’s the goal here?

Build up enough of an investment fund so you can slow down later and enjoy life. Your investment funds will start paying you an income later. We don’t want to be grinding it out until we are 70.

Today You, and Future You.

It sounds like the plot from a cheap sci-fi movie, but think for a minute that you are two different people. The financial well-being of Future You is being decided by the actions You are taking today. Future You can’t unscramble the egg later on this one.

Buy the wrong car or house? Future You can fix that later, but they can’t create a sizable investment portfolio that provides an income later in life to live stress-free. That needs time.

Prioritize decisions that benefit Future You. Yes, the project deadline is just 4 days away, and the client is losing their mind. However, forgetting to invest that $23,500 in your Solo 401(k) this year will cost Future You $90,000 twenty years from now. How? More below.

The good news? It's (almost) never too late to start investing.

Meet Sarah: A Freelancer Who Started at 52

Sarah had been a set designer for 25 years. She always paid the bills and even put her daughter through college, but saving for retirement? It simply hadn't happened.

Instead of ignoring the issue, Sarah took action. She created a straightforward plan:

Maximize retirement contributions using an Solo 401(k) — aka the Individual 401(k).

Opened a HSA and a Backdoor Roth IRA. More on these below.

Slightly downsized her living situation to free up funds for investing.

Cut some discretionary expenses, you know, a few less $6 lattes.

She used a simple investing strategy, a Vanguard Target Date Fund. At Freelancer Finance, this is our holy grail: simplicity, low fees, and no Wall Street overly complicated BS. We don’t need them or their fees.

By age 65, Sarah had built a respectable retirement nest egg and established consistent income streams that could support her lifestyle well into the chill-out years.

"Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn't, pays it." – Albert Einstein

Time makes you money. Start Today—Not Tomorrow

Compound interest. It’s like magic. Don’t take it from me, that’s why I just quoted crazy old Einstein.

Historically, your investment portfolio will bounce up and down with the stock market, but it should grow at an average of around 7% per year (it could be as high as 9%). That annualized gain, combined with your contributions, creates a snowball effect. It accelerates exponentially (slow now, faster later), with the 7% gain repeated again and again, multiplying upon itself until it becomes a monster. That’s why time is key.

The (easy) math

The most important thing is to start investing with whatever you can. Life doesn’t always leave you with bags of cash lying around. Get the accounts open and start trickling money in; it all adds up. The example below is just to illustrate how you can reach a massive number in a relatively short amount of time.

Try to save and invest 10% of your monthly income, if you can.

Save $2,000/month starting at 50 = $655,000 by 65

Below is a chart showing a $1,958/month contribution, which is $23,500 a year (for age 50+, it’s actually $31,000). That’s the personal Solo 401(k) contribution up to age 49 in 2025. Your biz can also add another 20-25% of what it paid you. Read all about it in the 401(k) guide.

Watch that sucker grow.

The 7% gain of $23,500 in the first year is $1,645. Kinda boring. If you continue to add $23,500 per year, you’ll have $655,000 at year 15. Notice the yearly gain in the right-hand column getting bigger and bigger? That’s the compounding snowball effect. Later, you begin making boatloads, and it all happens in the background. That’s passive income.

The biggest mistake isn't starting late—it's continuing to delay. Even modest contributions now can grow significantly over the next 10-15 years.

If you're 50 and can save $1,000 per month until age 65, you could accumulate approximately $300,000 (assuming a 7% annual return).

If you can save $2,000 per month, that could grow to around $600,000.

If you start at age 40, you’ll most likely end up with $1.5 million.

Why isn’t compound interest math obvious? Humans are not particularly adept at thinking about the distant future; our brains haven’t evolved fast enough. It wasn’t that long ago that we were being eaten by something toothy at the ripe age of 35. Now we can easily live to 85+. Know any 85-year-old cavemen?

Why We Suck At Saving For Retirement

Why do so many smart, resourceful self-employed professionals suck at investing for later?

No automatic enrollment in an employer-sponsored 401(k) plan with a match dropped in your lap by an employer.

Inconsistent income, making regular saving a challenge.

Task overload—The need to handle everything yourself, including retirement planning.

The Midlife Advantage

Being in your 40s or 50s without retirement savings isn't ideal, but it comes with surprising advantages:

You're likely in your peak earning years. Many freelancers and self-employed professionals earn more in their 40s and 50s than they did in their 20s and 30s.

You may have fewer expenses. If you have children, they might be older now, which could reduce childcare costs or tuition payments. Mommy and Daddy have to invest for later; you’re off the payroll now, kid.

You have special catch-up options. Shockingly, Uncle Sam actually wants to help you save more at 50+ and lets you invest and deduct more.

“The best time to plant a tree was twenty years ago. The next best time is today.” - Ye olde wise saying

Your 5-Step Freelancer's Retirement Plan

Here's how to create your own retirement success story, starting today:

Step 1: Envision Your Future

As a freelancer, "retirement" might not mean stopping work altogether. Consider:

Tapering your workload later on, rather than quitting entirely. As freelancers and self-employed, we can often slow down our workload, unlike full-time staffers. Fire the pain-in-the-ass clients, keep the few you want to work with.

What kind of lifestyle do you want?

How much monthly income will you need? Whether you live in NYC or on a small Greek island, the living costs will be significantly different, and your money will stretch further in a low-cost location.

Step 2: Clear High-Interest Debt and Have Emergency Savings In Place

Before ramping up your investing:

Focus on paying off credit cards and high-interest loans. Those interest rates are the worst and most damaging to Future You. Rolling credit card debt is a financial vampire, at 20-22% it’s sucking the life out of you; drive a stake through its heart. Consider consolidating debt if it makes financial sense.

Mortgages are fine as long as they are at a reasonable interest rate. If you have a 3 to 6% mortgage, consider not making extra payments. Your investments will earn 7-8% over the long term, so it may be better to invest that extra money rather than paying off your house faster.

Have 3-6 months of expenses in an emergency fund. Read about where to stash your cash here.

Step 3: Set Up the Right Retirement Accounts

As a self-employed person, you have powerful options, with much better than what most staffers have access to. Uncle Sam has done us independents a solid on this one, shocking, I know. All of these accounts are the same in that they can hold ETFs, mutual funds, and stocks. The only difference is how they are taxed, or not taxed at all. Think of the accounts as a wrapper around the candy.

START HERE:

The Solo 401(k):

The amazing retirement account just for freelancers and single-person businesses. Read the complete guide here.

Contribution limits in 2025:

👉 Up to age 49: $70,000

👉 Age 50+ is: $77,500

👉 Age 60-63: $81,250

It’s a massive tax deduction and grows tax-free. When you start withdrawing funds, it is taxed as income. This is not a bad thing.

To fund the Solo 401(k) you must use 1099 income. If your income is W-2, use the Roth IRA below, plus a HSA.

IF YOU’RE MOSTLY W-2, OR AS AN ADDON TO THE Solo 401(k):

Backdoor Roth IRA

Contribution limit in 2025:

👉 Total Max to age 49: $7,000

👉 Total Max is 50+ is: $8,000

Perfect for freelancers who are mostly W-2, like those in the film industry.

A great supplement to other retirement accounts. You can have an Solo 401(k) and a Roth IRA; the limits are separate.

Your money goes in after tax from your personal bank account, and is tax-free when you withdraw it.

If you earn too much to contribute to a Roth IRA, you can use the backdoor funding method. Read about it here.

BONUS ROUND:

HSA (Health Savings Account)

It’s designed to provide a tax deduction for medical expenses, but can also be used as a long-term investment account.

Contributions are a tax deduction. If you spend the money on qualified medical expenses, they are tax-free when you reimburse yourself.

After 65, you can spend the money on anything, but the withdrawal is seen as income (the same as a pre-tax Solo 401(k). Read about the HSA here; it’s a fantastic account that is often underappreciated.

Contribution limit in 2025:

👉 Singles: $4,300

👉 Family: $8,550

Step 4: Invest Simply and Consistently

You don't need complex investment strategies or even to follow the stock market. Ignore the noise, the guy on MSNBC, and your colleague at the water cooler. Since World War II, the S&P 500 has gone up an average of 10% per year. Our portfolios are expected to make 7-8% yearly because they mix U.S., international, and Bonds.

We use classic, time-tested investments to create a simple diversified portfolio. Read a quick primer on the stock market here.

Save your money, then invest at the start of every quarter. You only need to spend twenty minutes every three months on this. That’s why it’s called ‘passive income.’

Want to buy just one fund? Use a Target Date Fund that invests your money and changes the mix between stocks and bonds as you get closer to retirement. Want to retire around 2060? Pick the Vanguard 2060 fund and keep stashing cash in it. Easy.

Want more control? Use the classic Three-Fund Portfolio. Buy three ETFs: U.S. stocks, international stocks, plus bonds. That’s all you need in the market. Read about it here. Wall Street's business model: convince you investing is hard, charge you for "help." It isn't. They can't.

Automate your contributions so they happen regardless of market conditions. Keep buying when the market crashes. Never sell when others are panicking. Stay calm.

The stock market can seem insane sometimes. It’s like a toddler throwing a tantrum, but it always grows up long-term and makes that 7-9%. In a nutshell: The market goes up 2/3 of the time, and down 1/3 of the time. Read more about it here.

Step 5: Be Flexible About Timing When You Slow Down

The beauty of being self-employed is flexibility:

Consider a phased retirement approach. Work some, or not at all.

Research the optimal age to start receiving Social Security. Later is not always better.

Develop passive income streams that work while you don't.

Your Next Steps

Pour coffee, silence your phone. This IS billable work—you're working for your most important client: Future You.

Today: Schedule 60 minutes to review your finances and research retirement account options. Ignore your clients for a few minutes, Future You needs you now.

This week: Open an Individual 401(k) (aka the Solo 401(k) or Solo 401(k) and/or a Roth IRA, and also a HSA. Guides: The Solo 401(k) guide. Roth IRA. HSA.

This month: Set up automatic contributions, even if they're small to start. Investing 10% of your pre-tax income is great; more is even better. Once in the retirement account, do not leave the money in cash. Invest it in ETFs or a Target Date Fund.

Later: Watch those accounts grow! Three to five years out from semi-retirement, I would recommend consulting a Certified Financial Planner (CFP). They charge a one-time fee for reviewing your financial situation, creating an investment and spending plan. CFPs have a fiduciary duty to do the right thing by you.

Watch out for ‘financial advisers’. They might be great, or they may be salespeople. Their annual fees can be brutal over the long term. Paying 1% per year will cost hundreds of thousands over the long term.Share: Please send this article to your friends and colleagues. We all need to discuss investing and help one another.

Your freelance journey has prepared you perfectly for this challenge. You've already proven you can adapt, be resourceful, and build something from nothing. Now, apply those same skills to creating your secure future.

Nobody cares that you started late. Literally nobody. The only person who will care is Future You, and they'll just be grateful you started.

It's not too late—it's just your time to begin. Fired-up? Let’s go. Please ask questions or leave feedback below!

Links

Schwab for the Three-Fund Portfolio

https://www.schwab.com/small-business-retirement-plans

ETrade if you want to go with a single Vanguard Target Date Fund

https://us.etrade.com/what-we-offer/our-accounts#tab_4

Fidelity for the HSA

https://www.fidelity.com/go/hsa/why-hsa

**I don’t receive any referral fees or commissions if you open an account using these links; I write these articles because I’m an investment geek and it pisses me off that the self-employed don’t get more help investing for later.

Would I like these co’s to advertise on the site and pay me? Yes. But only the companies I like.