Robinhood 3% Cashback Card — then invest it.

The ‘don’t blame me’ blurb: I am not a financial advisor, portfolio manager, or accountant. This is not tax or investment advice; it’s information to get you going. Please consult your trusty professional and do your due diligence. Carry-on!

TL;DR

3% cash back on all purchases, paid into a Robinhood account.

Invest the cash back in a sensible ETF like VTI — Vanguard Total U.S. Stocks.

Spending $1,500/month = $45 cash back. @10% growth x20 years = $30,000.

No annual card fee.

Must have a Robinhood Gold Account — Cost $50/year. (The cash back from the first $1,700 you spend will cover that.)

Ignore the rest of the casino-like options in Robinhood.

I don’t get paid a referral by Robinhood. This is just a good deal for us investors.

The Robinhood Gold Card is a great deal for investors; instead of trying to use points to shop or travel, we’ll invest and spend big later in life.

With no annual fee, the 3% unlimited cashback is almost unheard of, and the card also offers some premium benefits (more below). There are other options to spend the points, but I’m going to ignore them and send the cash into the Robinhood brokerage account and invest it.

Robinhood. What’s the deal with these guys?

I want to be upfront here about Robinhood as a brokerage; they’re not my favourite. What’s the problem? They have gamified investing to encourage people to trade more, which generally is a bad idea for the investor. They make more money when you frequently trade. They have also added risky options trading, crypto, and prediction markets. Those last three are betting and speculation, not investing.

I use Robinhood’s brokerage account only to earn the cashback, then I invest it in something like VTI or VXUS. Or buy VBIL for a risk-free, state-tax-exempt savings option. All my other accounts — Solo 401(k), Roth IRA, and taxable brokerage account - are with Schwab.

What I do like about Robinhood is that they were the first to offer free trading, which forced the big players like Schwab and Fidelity to follow suit. It wasn’t long ago that it cost $10-$20 every time you placed a trade.

Card benefits

They’re comprehensive and rival many cards with an annual fee:

No annual fee

3% cash back on all purchases, 5% on travel when booking through their travel portal.

No foreign transaction fees

Extended Warranty Protection (one of my favorites and has saved my ass a few times.)

Auto Rental Collision Damage Waiver

Return Protection

Purchase Security

Travel and Emergency Assistance

Visa Signature Concierge Service

The card itself has a premium look and feel and has its own very well-designed app.

Why switch cards?

These days, I’m finding booking travel with points is a pain in the ass. If you need to change flights or deal with cancellations, booking through a third-party travel site is not your friend. In the past, travel sites offered lower prices, but these days, airlines often offer the same prices, and their apps are great. Also, using points to shop usually results in a lower value per point. So, why not get the points as cash? Then you can use them however you like.

Can I use the card for my Biz?

Check with your accountant on this one, but the short answer is:

Sole Trader: Most likely yes, as you trade under your own name. But make sure you only put business expenses on the card. Never mix business and personal, as it makes it a nightmare to keep track of what is what. Your accountant will disown you if you do, and if audited, the IRS will probably waterboard you.

S-Corp or LLC: It’s a bad idea. The point of these entities is to separate you from you and your personal assets from your business. Having a card in your own name can create an issue there. Your business card should have your biz’s name on it.

The App - Using the points

The card has its own app (of course), which is well designed. There are other ways to redeem the points for shopping, merch, and even a gold bar. Honestly, some of the options are pretty idiotic, in line with Robinhood’s casino-like gamification of investing.

Ignore them, as some do not give you the full 3% cash back. Instead, opt to have the cash deposited into your Robinhood account.

Choosing to pay your card balance with the points only gets you x0.7 per point, not the full 1c per point, so avoid that.

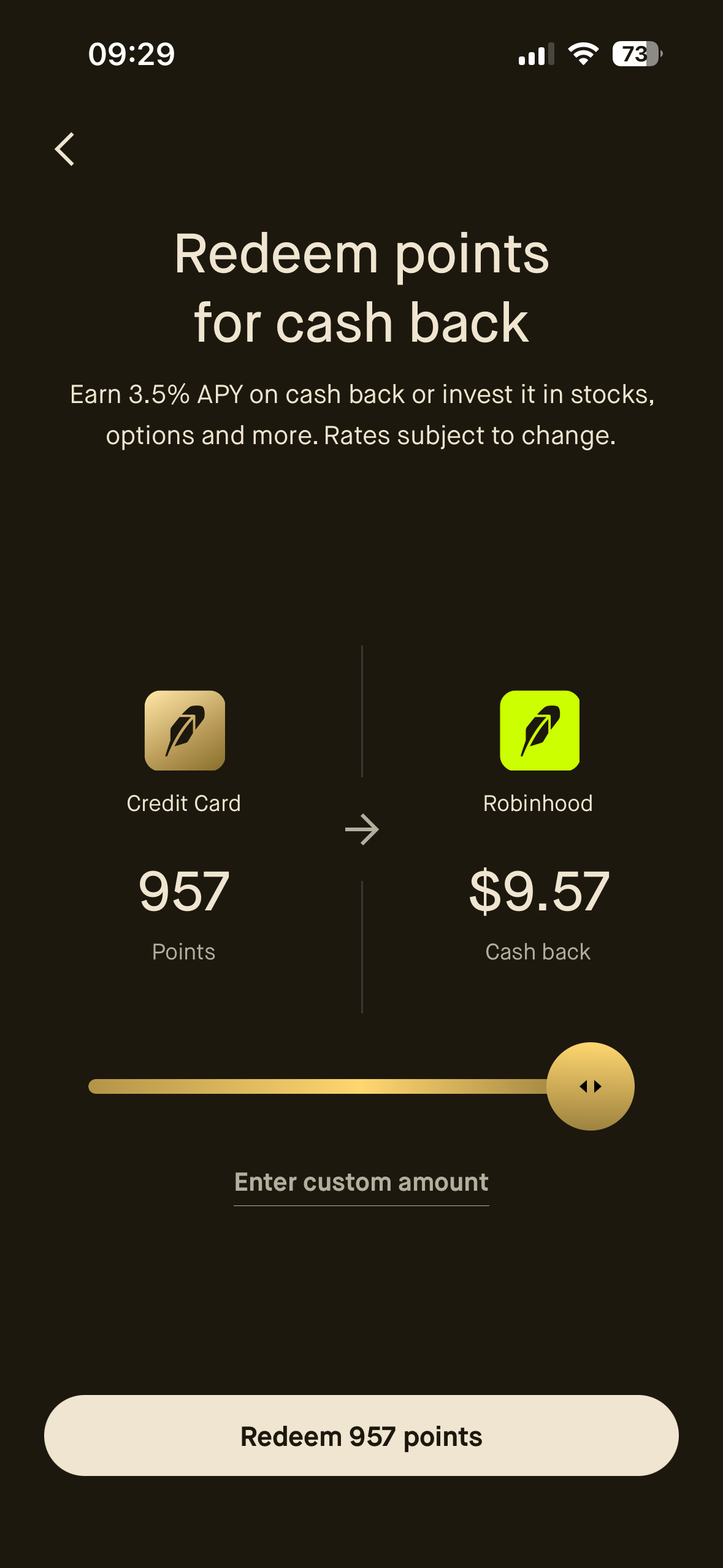

Robinhood card app points screen

Drag that slider to transfer the moolah.

Investing the cash.

Once you’ve selected the Cash Back option, open the Robinhood app and trade.

Robinhood offers fractional shares, so you can invest your funds immediately, which is a great feature. If VTI is $333 per share, the $19.32 in my account isn’t enough to buy a whole share, but with fractional trading, I can invest it immediately and get a fraction of a share. Making a trade is free, so there is no issue buying frequently.

You can also have the cash placed into a high-yield savings account in the trading app (not in the gold card app). Go to Account (person icon) → Menu (3 bars top left of screen) → Investing → Cash sweep program. As I mentioned above, if you want a savings option I think buying VBIL is a better option: similar rate, no state tax.

Itty-bitty trades.

Just want the cash back in your own bank account?

Transfer the points as above to your Robinhood trading account.

In the trading account, go to Account (person icon) → Menu (3 bars top left of screen) → Transfers → Withdraw.

The ‘standard’ transfer is free and takes 4-5 days. An instant transfer costs $1.

Applying for the card

Open a Robinhood Gold trading account. Then apply for the credit card.

There is a ‘Reserve your spot’ button to apply. I clicked it, and sure enough, a week later, I received an email saying I could apply. This is just Robinhood using scarcity marketing to make you feel that the card is in demand and you’re special. But just like your mean 5th-grade teacher told you — you’re not special. But you are a savvy investor.

Keep Calm and Keep Investing

The trick here is to ignore all of the bling and gambling that the Robinhood trading app offers. They don’t care about you as an investor; they offer all of the other stuff to hook you and make more money for Robinhood Inc.

I would not go near margin trading, options, crypto, or prediction markets — none of it. Pick a low-cost ETF like VTI, or start a classic three-fund portfolio.

Example: Spending $1,500/month = $45 cash back. Investing that in VTI and getting the historic 10% annual growth rate of the U.S. market x20 years = $30,000. Try the math using the compound interest calculator here.

Remember, picking individual stocks is fun, but it doesn't work in the long term. 88% of active fund managers, that’s teams of Ivy League grads who are picking stocks and trying to beat the market, do WORSE than the S&P500 Index after 15 years. See the S&P SPIVA study website here.

And always, always fully pay off the card balance every month. Credit card debt is the ultimate evil, even more than your mother-in-law or your neighbor’s vicious Chihuahua.

Comment below!