The Knowledge Blog

Posts on finance, investing, business practices, and other oddball topics for freelancers. Grab your favorite beverage and get stuck in.

Latest Posts

A Freelancer's Guide to Not Dying Broke — Why we suck at saving for retirement.

Freelancers, let's talk about the elephant in your home office: retirement savings.

The ‘Retirement in the USA: The Outlook of the Workforce - 2025’, survey from the Transamerica Center for Retirement Studies is out, and it’s an eye-opener.

While your traditionally employed friends have HR departments force-feeding them 401(k) plans, you're busy trying to figure out if you can expense that second monitor as a business expense.

The Roth and Backdoor Roth IRA — great for W-2 earners, 401(k) and Solo 401(k) holders.

The Roth IRA — With simple set-and-forget investing, it’s easy to have around $1 million in retirement.

Freelance or Self-Employed? Stop Working Full-Time Earlier: How Much Do You Need?

Forget the outdated retirement stereotype of working until you drop, then shuffling off with a gold watch. As a solopreneur or freelancer, you can design something better: working less while your investments pick up the slack. The question is: how big does that investment portfolio need to be?

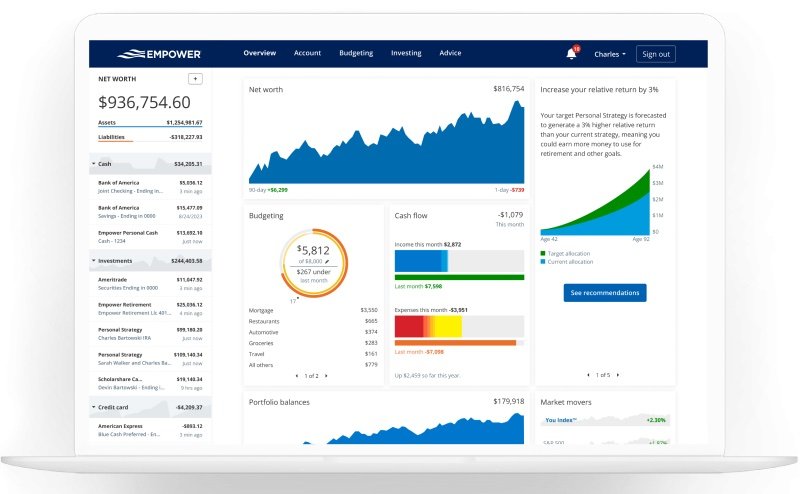

Empower Financial Dashboard — one to rule them all

The Empower Financial Dashboard: the magic crystal ball for freelancers that shows you your whole financial and investment life. And, it's free.

My name is Chris Albert. I’m a 52-year-old freelance Director of Photography and studio owner who built a seven-figure portfolio from zero—no inheritance, no financial background, just consistent saving and sensible investing over 30 years.

Financial institutions consider me a ‘high net-worth individual’. At Schwab, as a $1 million+ account holder, I qualify as a Schwab Private Client Services customer, and, under SEC rules, I am considered an Accredited Investor.

Why the website? I built this site because I couldn't find one place that explained what and how freelancers like us should set up retirement accounts (the Solo 401(k), Backdoor Roth IRA, and HSA) and what investments to put in them—without the sales pitch, fees, or the overly-complicated Wall Street products.

We are going to get rich slow. In later years, live more, work less.