The Knowledge Blog

Posts on finance, investing, business practices, and other oddball topics for freelancers. Grab your favorite beverage and get stuck in.

Latest Posts

The Three Investment Accounts That Freelancers Should Have

Freelancers can shelter up to $96,250 in 2026 using three tax-advantaged accounts. Learn which to open first and how much you can contribute.

Freelancers, it’s time to rebalance Your Three-Fund ETF Portfolio

Rebalancing is simply bringing your portfolio back to your target allocation. That’s it. No spreadsheet pain. No Wall Street jargon. Better yet, I have a nifty calculator to do the math.

How Freelancers Can Max Out 2026 Contribution Limits - Solo 401(k), Roth IRA, HSA

Here we go, 2026! What could possibly go wrong, right?

Read about the new 2026 limits for the i401(k), also known as a Solo 401(k). Plus the Roth and Backdoor Roth IRA, and the awesome HSA.

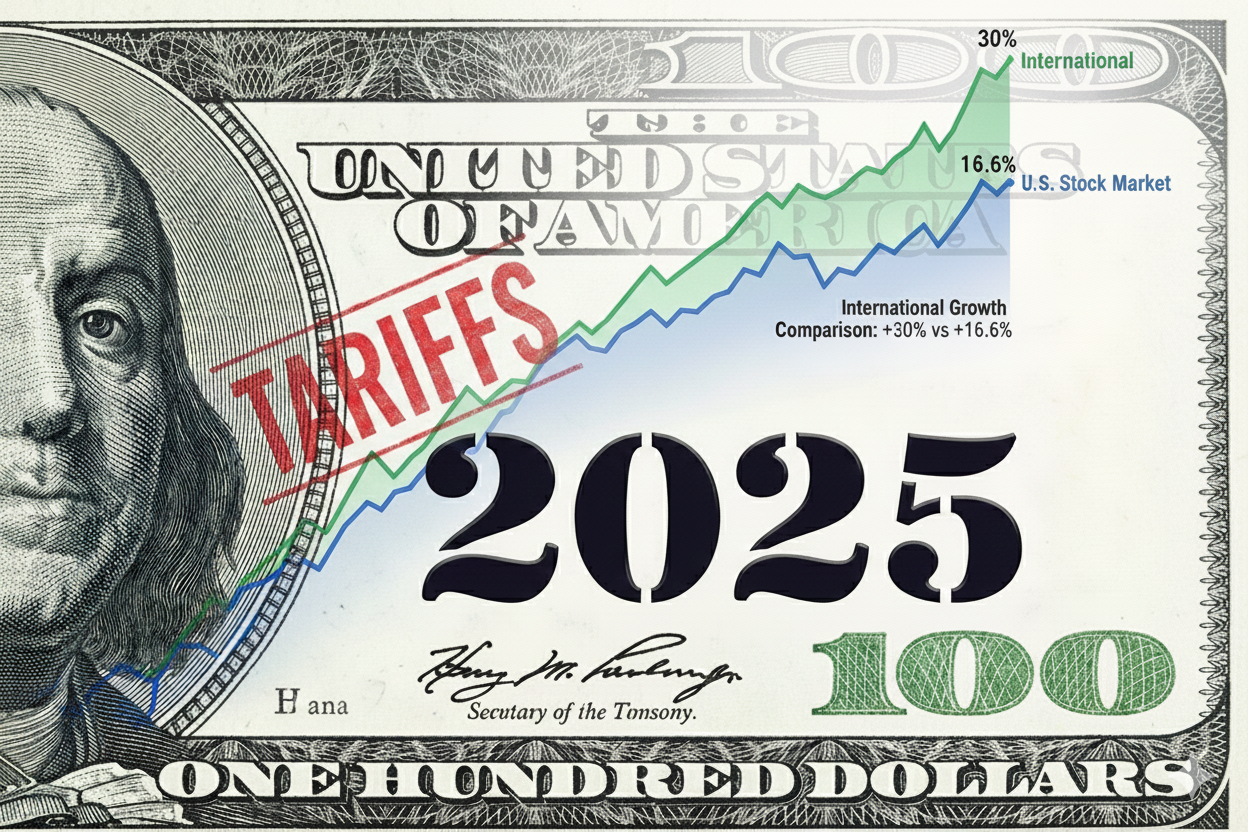

The 2025 Market— The Headwinds, Performance and the ‘Vibecession’.

How did 2025 turn out? - The U.S. market coped with some novel pressures and the vibecession continued. Meanwhile, International outperformed.

The Silver Lining If You’ve Had a Tough Financial Year — Roth Conversions

Did you have a terrible year financially? That painful low-income year might at least have a silver lining. If you had a bad year, your marginal tax rate will be lower than usual, so now might be a good time for a Roth conversion.

Year-End 2025 — Cut Your Tax Bill By Maximizing Your Contributions

Max out the contributions to your retirement accounts before year's end. Now is the time to get your QuickBooks in order and talk to your accountant before the end of the year. Don’t wait.

The freelancer investment trinity — i401(k), HSA, and Backdoor Roth IRA.

Robinhood 3% Cashback Card — then invest it.

The Robinhood Gold Card is a great deal for investors; instead of trying to use points to shop or travel, we’ll invest the unlimited 3% cash back and spend big later in life.

Freelance or Self-Employed in your 40s or 50s? Start Investing for Later, Now.

Are you freelance or self-employed in your 40s or 50s without retirement savings? You're not screwed. Here's the math: Start investing $2K/month at 50, and you'll have $600K by 65. The biggest mistake isn't starting late—it's not starting today.

What’s in the 2025 Big Beautiful Bill for Freelancers and Self-Employed?

We look at what’s in the 2025 Big Beautiful Bill for Freelancers and Self-Employed.

A Freelancer's Guide to Not Dying Broke — Why we suck at saving for retirement.

Freelancers, let's talk about the elephant in your home office: retirement savings.

The ‘Retirement in the USA: The Outlook of the Workforce - 2025’, survey from the Transamerica Center for Retirement Studies is out, and it’s an eye-opener.

While your traditionally employed friends have HR departments force-feeding them 401(k) plans, you're busy trying to figure out if you can expense that second monitor as a business expense.

Where to Put Your Emergency Fund: Best Options for Freelancers

How much emergency fund do freelancers and self-employed individuals need? Compare HYSA, Treasury ETFs like VBIL, and other options for self-employed workers. State tax savings tips included

The Roth and Backdoor Roth IRA — great for W-2 earners, 401(k) and Solo 401(k) holders.

The Roth IRA — With simple set-and-forget investing, it’s easy to have around $1 million in retirement.

2025 and Your Tax Rate — it’s not one rate

It’s often misunderstood how the states and feds tax us. A misconception is that once someone hits a certain income, all of their hard-earned money gets taxed at a higher rate. This is not the case.

2024 — How did our Solo 401k do and the ‘vibecession’.

2024 — The markets, a Trump election victory, and whatever happened in your freelance industry. What did it all mean for our i401k portfolio and the goal of chill-retirement?

Freelance or Self-Employed? Stop Working Full-Time Earlier: How Much Do You Need?

Forget the outdated retirement stereotype of working until you drop, then shuffling off with a gold watch. As a solopreneur or freelancer, you can design something better: working less while your investments pick up the slack. The question is: how big does that investment portfolio need to be?

The Three-Fund Portfolio — Freelancers, it’s all we ever need in the stock market.

The Three-Fund Portfolio — Freelancers, it’s pretty much the only investment we need in the stock market. U.S. Stocks, International Stocks, plus Bonds

The List: Tax-advantaged accounts for freelancers — tax saving, wealth multipliers.

More in our series of ‘More for us, less for you IRS!’

Below is a list of the various tax-advantaged accounts we can have as freelancers. Learn the ways of the force, I mean accounts. As freelancers, investing is our ultimate side hustle.

The Stock Market. Big and Scary? Nope - It Creates Wealth In The Background.

The stock market is often widely misunderstood due to the hype in the media reporting on short-term market moves. That and the jibba-jabba of your next door neighbor or some guy in a bar. It’s the long term that matters. We need to ignore the noise.

FinCEN - Beneficial Ownership Information Report—Cancelled!

The Beneficiary Ownership Information Report.

UPDATE: As of March 26th, 2025 the whole thing got thrown out. Now only foreign companies have to fill it out.

Solo 401(k) investors — IRS Form 5500-EZ could cost you a $150,000 fine. EVERY YEAR.

i401k investors — IRS Form 5500-EZ could cost you a $150,000 fine. EVERY YEAR.

My name is Chris Albert. I’m a 52-year-old freelance Director of Photography and studio owner who built a seven-figure portfolio from zero—no inheritance, no financial background, just consistent saving and sensible investing over 30 years.

Financial institutions consider me a ‘high net-worth individual’. At Schwab, as a $1 million+ account holder, I qualify as a Schwab Private Client Services customer, and, under SEC rules, I am considered an Accredited Investor.

Why the website? I built this site because I couldn't find one place that explained what and how freelancers like us should set up retirement accounts (the Solo 401(k), Backdoor Roth IRA, and HSA) and what investments to put in them—without the sales pitch, fees, or the overly-complicated Wall Street products.

We are going to get rich slow. In later years, live more, work less.